Financial literacy gives people the valuable skills needed to navigate adult life; however, many people don’t take advantage of these skills and are clueless when it comes to handling their income and investments. Unlike their glamorized depiction in popular movies and TV, the reality of stocks is that handling them is not an easy endeavor. As a result of student initiative, the Stock Market Club helps prepare its members for tomorrow by studying stock behavior and striving to increase interest in financial literacy.

One of the biggest concerns for adults today isn’t making money, but knowing how to expand one’s wealth. The club helps demonstrate that investment in stocks is a viable way to make the most out of one’s income while dodging high tax rates.

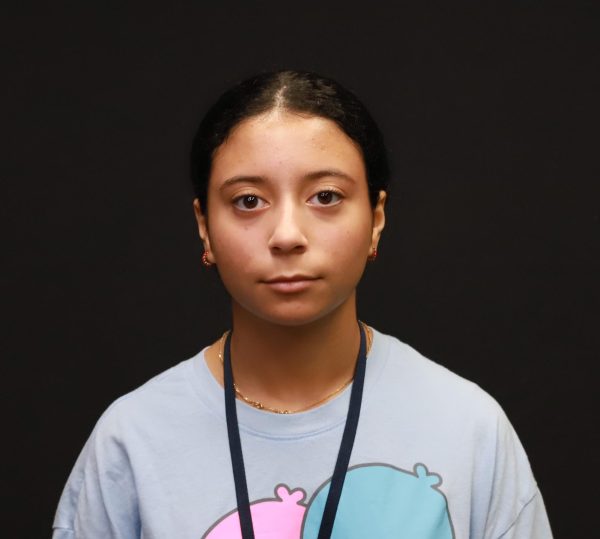

“The most important part of the club is learning how to put your money into investments for your future, so that not only does your…wealth grow in the future, but it also is stable and preserved,” senior and club president Benjamin Vu said.

The club participates in activities that give people a little more hands-on experience with handling their investments. The club plays a particular stock market simulator that allows them to see how well a person would do in real life; the key to predicting the performance of a stock and mastering the simulator is to pay attention to certain details beforehand.

“You want to see the stability of the company–if they’re firing a bunch of people then that’s not really good stock, it’s kind of unstable,” club secretary Brandon Vu said. “[You also want to see] if they’re selling a stable product–like coke [for example]; everybody’s going to buy Coca Cola and keep the company’s value steady.”

Although stocks are unpredictable for the most part, there are certain aspects or events that can be taken into account when searching for a stock to invest in. The club also highlights that being aware of the stock market’s performance helps broaden one’s perspective on global events and their consequences.

“I think global events and their effect on the economy are overlooked; people like to point out the political and social effects [of global events] but people don’t look at the economic effects upon the well-being of average citizens,” Benjamin said.

A common issue in regards to investment is how the popularity of a certain stock or item can distract from its unstable value. The club helps reinforce knowledge about good as well as bad attributes of a stock and why their value is as shown.

“[People attempt to] buy the cool thing, like NFTs or something popular,” Brandon said. “But it’s better to [stick with] something stable and boring because that’s going to do well in the stock market.”

While analyzing stocks is no doubt the Stock Market club’s strong suit, the club also wishes to shift gears and look at a variety of investments. The rise of inflation and the cutdown on wages only solidifies the dire need for financial literacy in today’s youth; the subject can instill them with confidence and prepare them for the reality of today’s world.

“[We] intend on branching out from not just the stock market but also other investments like bonds and a bunch of other financial assets that people can invest in and also learn about,” Benjamin said.